Tom woke up excited, he was joining a climate rally for the first time. He always considered himself a pro-environment person. But now, seeing Greta and all the protests happening around the world, he felt inspired, even called to participate. The experience was exhilarating, to be in a peaceful protest with hundreds of people publicly declaring they believe in global warming and want to see change. Calling government and multinational corporations to take responsibility for their actions.

After the rally, Tom invited a couple of friends he met at the rally to a local restaurant to “celebrate” how times are changing and in the end, he insisted on paying the bill. Tom is a teacher in a small public school and he is very invested in his community. The restaurant is locally owned and Tom is a personal friend of the owner who strives to pay a living wage and source local ingredients. They both want to support a local and sustainable economy. Tom pulled his card to pay, unaware of the irony and contradiction of his actions. Tom and his restaurant owner friend are clients of one of the big five banks.

If you bank with any of the five big banks in Canada, your money is being used to finance fossil fuels and accelerate global warming.

The big Canadian banks (RBC, TD, CIBC, ScotiaBank and Bank of Montreal) are among the biggest sponsors of fossil fuel industries using the money from Tom, the restaurant owner and millions of other Canadians who would never agree with that. It gets worse, they are not planning to stop doing that anytime soon.

The infographics are from a report published this year. Figure 1 shows in the vertical axis, that big Canadian banks (red squares) have a huge stake in the fossil fuel business. The horizontal axis shows that restriction policies to phase out that kind of investment is practically non-existent. The five Canadian banks are all in the bottom ten for their overall fossil policies.

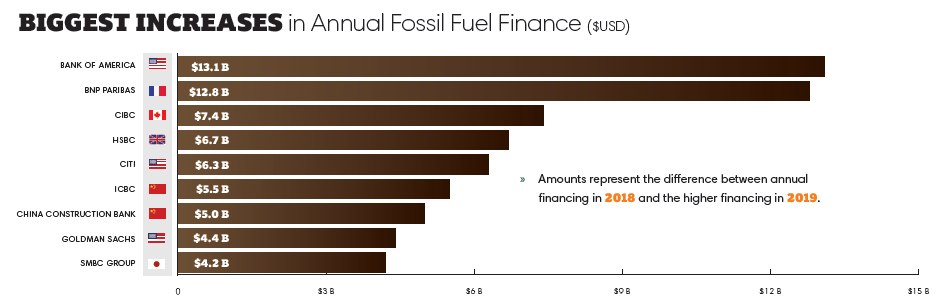

Three out of five big banks are among the worst banks since the Paris Agreement (2016-2019), the dirty dozen list(Figure 2.). Together, they invested a total of US$342 billion in fossil fuels. The fourth one doesn’t fall far from that in the 16th place and total investments of US$82.115billion. And the last of the five is on the list of the biggest increases(Figure 3.) in fossil fuel investment with a 62% increase between 2018 and 2019.

That is one of the reasons that even with growing public support to shift away from fossil fuels, countries are increasing fossil fuel production. A webinar about Divestment hosted by an organization called For Our Kids on November 5 touched on this and a few other points. The webinar is available online (see below).

Take Action

All those big numbers might seem overwhelming but there are a few things we can do today.

Invest on a sustainable future

Transfer your personal/commercial account, mortgage, loan or any other financial arrangement you have from those banks to a credit union that is more likely to invest in local initiatives and have clear policies around sustainability. Remember to let your former bank know why you are doing that.

This move makes sense even from a purely economic perspective, the sector is on a steady decline due to multiple compounding factors. Extraction is becoming more and more difficult making the EROI (Enery Return On Investment) shrink. If you don’t want to take my word for it (or science’s), even the American conservative who dismiss climate change as “a sidebar to the greater predicament of economic contraction”, understand that we will never have cheap oil again.

In general, we will have stricter regulations, making the whole process to get approvals for fracking, drilling and mining more costly. There are many indications that those two trends will increase over time, making fossil fuel investments riskier and less profitable. COVID-19 also hit the sector hard. Just because they are big, it doesn’t mean they know what they are doing or that they are safe. I believe we all learned the “too big to fail” lesson.

The EROI for discovering oil and gas in the US has decreased from more than 1000:1 in 1919 to 5:1 in the 2010s, and for production from about 25:1 in the 1970s to approximately 10:1 in 2007.

(Guilford et al., 2011).

I live in Canada so I am focusing on the big five. But if you live in the States, Brazil, Japan, France or pretty much anywhere around the world you can make that choice too. Read the report or call your bank to get more information.

Spread the word

Tell your family, friends and business partners that this is happening. Share this post or watch the webinar with them and invite them to do the same.

Luis, thanks for sharing this. I’ve often held the big 5 in contempt but without any clear data to back it up. One thing to highlight is that a lot of Socially Responsible Investments will avoid fossil fuel investments directly, but then invest in the big 5, which in turn invest in fossil fuels. It’s very hard to find a mutual fund in Canada that doesn’t contain one of the big 5 banks in it. We also need to tell those people that just because the banks aren’t the ones drilling or mining, they probably do a lot more damage (this report didn’t even tough on all the shady financial services that these companies undergo to create new ways to make money)!

LikeLiked by 2 people

Hi Daniel. Yes, it is a very informative report. And you are right, it addresses just one very small portion of the problem. Many of the mechanisms used by the financial system are inextricably connected and some are pretty cryptic. It’s overwhelming just trying to think about the whole system. I hope this post was clear and simple enough for people in general to understand this particular issue and what to do about it. For those who want to explore a little more, I put some hyperlinks with info about the 2008 crisis and de-growth. My plan is to write more about this in future posts.

LikeLiked by 1 person